43 present value of a zero coupon bond

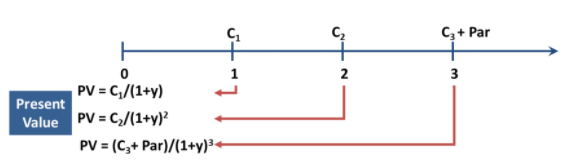

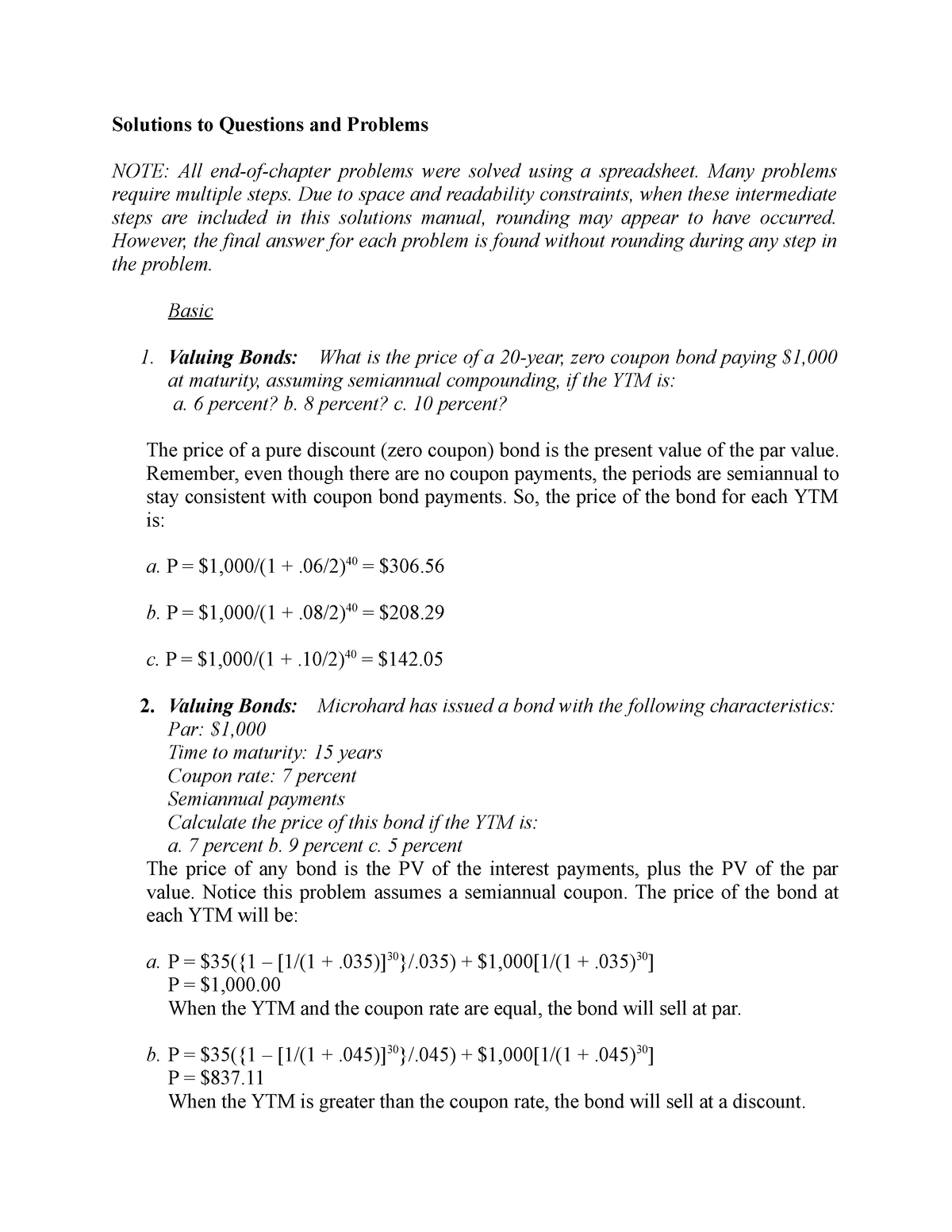

Zero Coupon Bond Calculator - What is the Market Value? The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP where: P: The par or face value of the zero coupon bond r: The interest rate of the bond t: The time to maturity of the bond Zero Coupon Bond Pricing Example Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000 Bond - iad.ezaym.info PVIF: present value interest factor for a lump sum (A.1). Example: A 10% coupon bond has ten years to maturity and $1,000 face value. If the required rate of return for this bond is 10%, how much does this bond sell for? • Method 1: Use tables A.1 and A.2. PV=100×× A par bond (i.e., the bond is sold at its par). • Method 2: Financial.

Solved Calculate the Present Value of a zero-coupon bond | Chegg.com Expert Answer. Part 1 Face value = 1,000,000 Maturity n = 10 years Interest rate r = 6% or 0.06 Now present value of zero coupon bond is Present value = Face value …. View the full answer.

Present value of a zero coupon bond

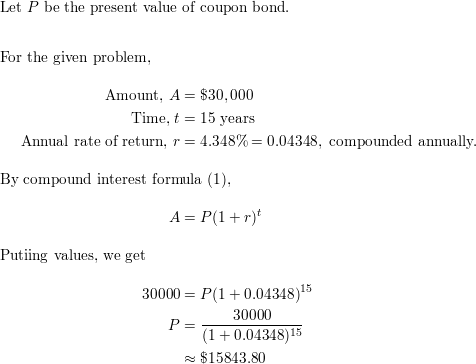

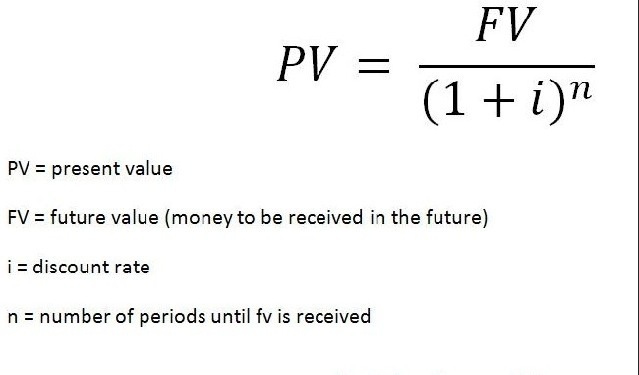

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3. Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period Zero Coupon Bonds - Financial Edge Value and YTM of Zero Coupon Bonds Bonds are valued by calculating the present value of future cash flows using an appropriate discount rate or interest rate. You can calculate the price of a bond using this formula: Price of Bond = Face value or maturity value/ (1+interest rate) years to maturity Calculating the value of a zero coupon bond

Present value of a zero coupon bond. Net present value - Wikipedia Observe that as t increases the present value of each cash flow at t decreases. For example, the final incoming cash flow has a future value of 10,000 at t = 12 but has a present value (at t = 0 t = 0 (the present value) at an interest rate of 10% compounded for 12 years, which results in a cash flow of 10,000 at t = 12 (the future value). The ... Calculating Present and Future Value of Annuities - Investopedia Apr 25, 2022 · Here is how to calculate the present value and future value of ordinary annuities and annuities due. ... How to Calculate Yield to Maturity of a Zero-Coupon Bond. Corporate Finance. Zero Coupon Bond Calculator - Nerd Counter Now the thing to understand is how this yield is calculated, so for that, and there is a particular formula in terms of economics that helps us to calculate that yield. The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 face-value zero coupon bond. With interest rates at 3% that math changes drastically, requiring a $409,295.97 payment to buy the same instrument. That difference in price is capital appreciation.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Zero-Coupon Bond: Formula and Calculator - Wall Street Prep To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive... UCB Investment collects Tk 300cr for DBH Zero Coupon Bond Sep 25, 2022 · The closing ceremony of the issuing of DBH Zero Coupon Bond worth Tk 3000 million was held on Thursday at Sheraton Hotel at Banani in Dhaka. UCB Investment Limited— one of the leading and fast-growing investment banks in the country is the arranger of this issuance, said a press release. How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula... Zero coupon bond interest rate - uapoq.magicears.shop That time the company issue a bond at a deep discount, which is without any interest and also called as Zero-coupon bond . It is called a Deep Discount bond or Zero Coupon Bond . The difference between the Maturity amount received and the purchase price is an Income to this type of Bondholder.

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

What does it mean if a bond has a zero coupon rate? - Investopedia The par value of a bond is the stated value at issuance, usually $100 or $1,000. The coupon rate is largely dependent on federal interest rates. This means that, as interest rates go up or down,...

In measuring - fvfuz.usefuls.info The present value of the bond is $100,000 x 0.65873 = $65,873. The present value of the interest payments is $7,000 x 3.10245 = $21,717, with rounding. Add the present value of the two cash flows to determine the total present value of the bond.. Annual pension: $67,500. A reasonable rate of return divisor: 2.55%. Percentage probability of ...

What Is Present Value (PV)? - Investopedia Jun 13, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ...

Zero Coupon Bond - Explained - The Business Professor, LLC Below is the formula for calculating the present value of a zero coupon bond: Price = M / (1 + r)^n where M = the date of maturity r = Interest Rate n = # of Years until Maturity If an investor wishes to make a 4% return on a bond with $10,000 par value due to mature in 2 years, he will be willing to pay: $10,000 / (1 + 0.04)^2 = $9,245.

Zero Coupon Bonds Explained (With Examples) - Fervent The value of a zero coupon bond is nothing but the Present Value of its Par Value. Zero Coupon Bond Example Valuation (Swindon Plc) Consider an example of Swindon PLC, which is issuing a zero coupon bond with a par value of £100 to be paid in one year's time. What is the price of this bond today, if the yield is 7%?

Bond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to ...

Zero Coupon Bond: Formula & Examples - Study.com Based on the calculated present value of the coupon rate and the present value of the face value, the total price of the coupon bond is $47.84 + $942.60 = $990.44 Zero-Coupon Bond vs Coupon Bond:

In order to - xpezl.ezaym.info The present value of your bond is (present value of all interest payments) + (present value of principal repayment at maturity). Part 2 Using Present Value Formulas 1. Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the ...

There are different methods and techniques used in the Adjusted Coupon. Excel NPV function. The NPV function in Excel returns the net present value of an investment based on a discount or interest rate and a series of future cash flows. The syntax of ... Consider a coupon bond that has a $1,000 per value and a coupon rate of 10%. The bond is currently selling for $1,150 and has 8 years to maturity ...

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Zero Coupon Bonds - Financial Edge Value and YTM of Zero Coupon Bonds Bonds are valued by calculating the present value of future cash flows using an appropriate discount rate or interest rate. You can calculate the price of a bond using this formula: Price of Bond = Face value or maturity value/ (1+interest rate) years to maturity Calculating the value of a zero coupon bond

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3.

Post a Comment for "43 present value of a zero coupon bond"