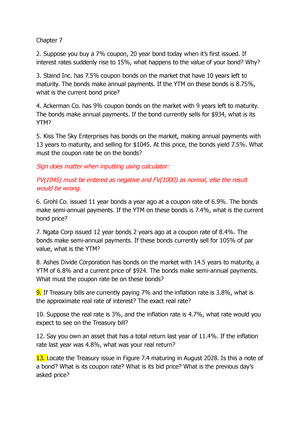

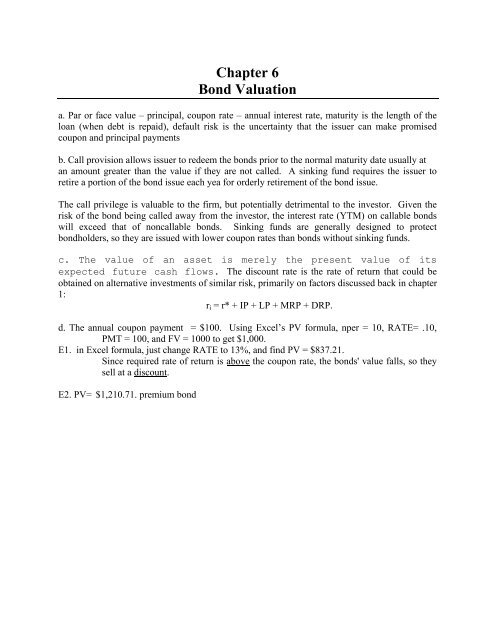

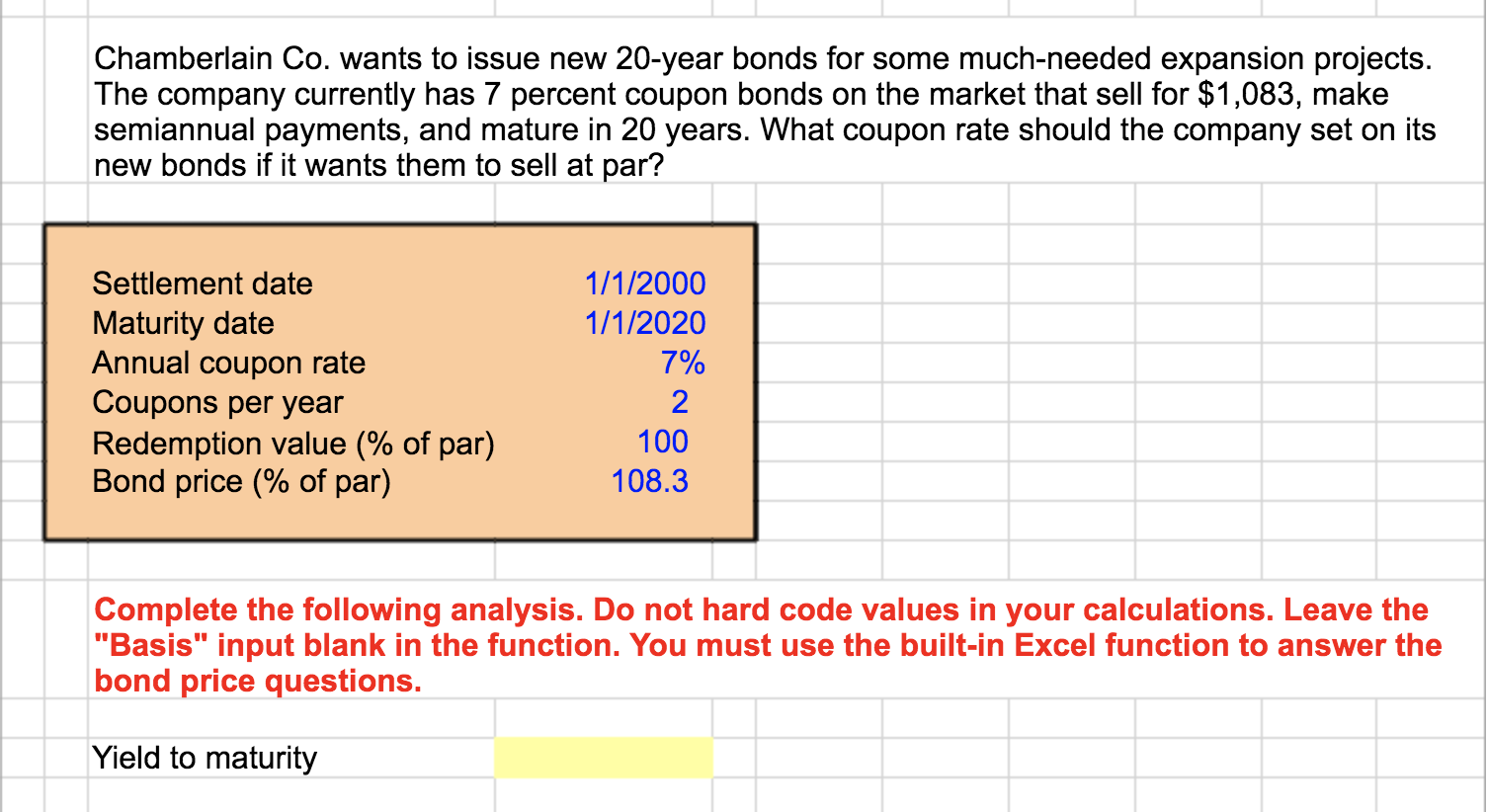

39 what coupon rate should the company set on its new bonds if it wants them to sell at par

What coupon rate should the company set on its new bonds if it wants ... 1 Answer to Bond Yields BDJ ... Fortune - Fortune 500 Daily & Breaking Business News | Fortune Oct 24, 2022 · Unrivaled access, premier storytelling, and the best of business since 1930.

Money: Personal finance news, advice & information - The Telegraph Oct 23, 2022 · The manufacturer says its normal but our consumer champion disagrees Katie Morley ‘Builders charged £20 to clean our gutters and then conned us out of £20,000’

What coupon rate should the company set on its new bonds if it wants them to sell at par

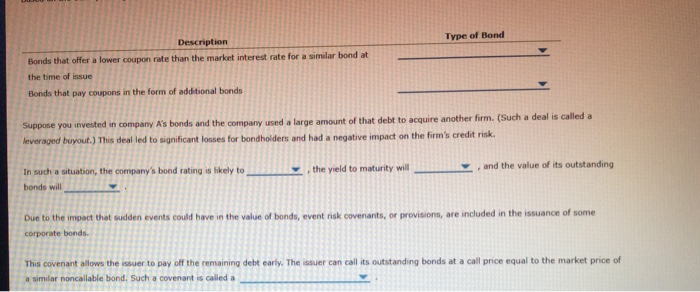

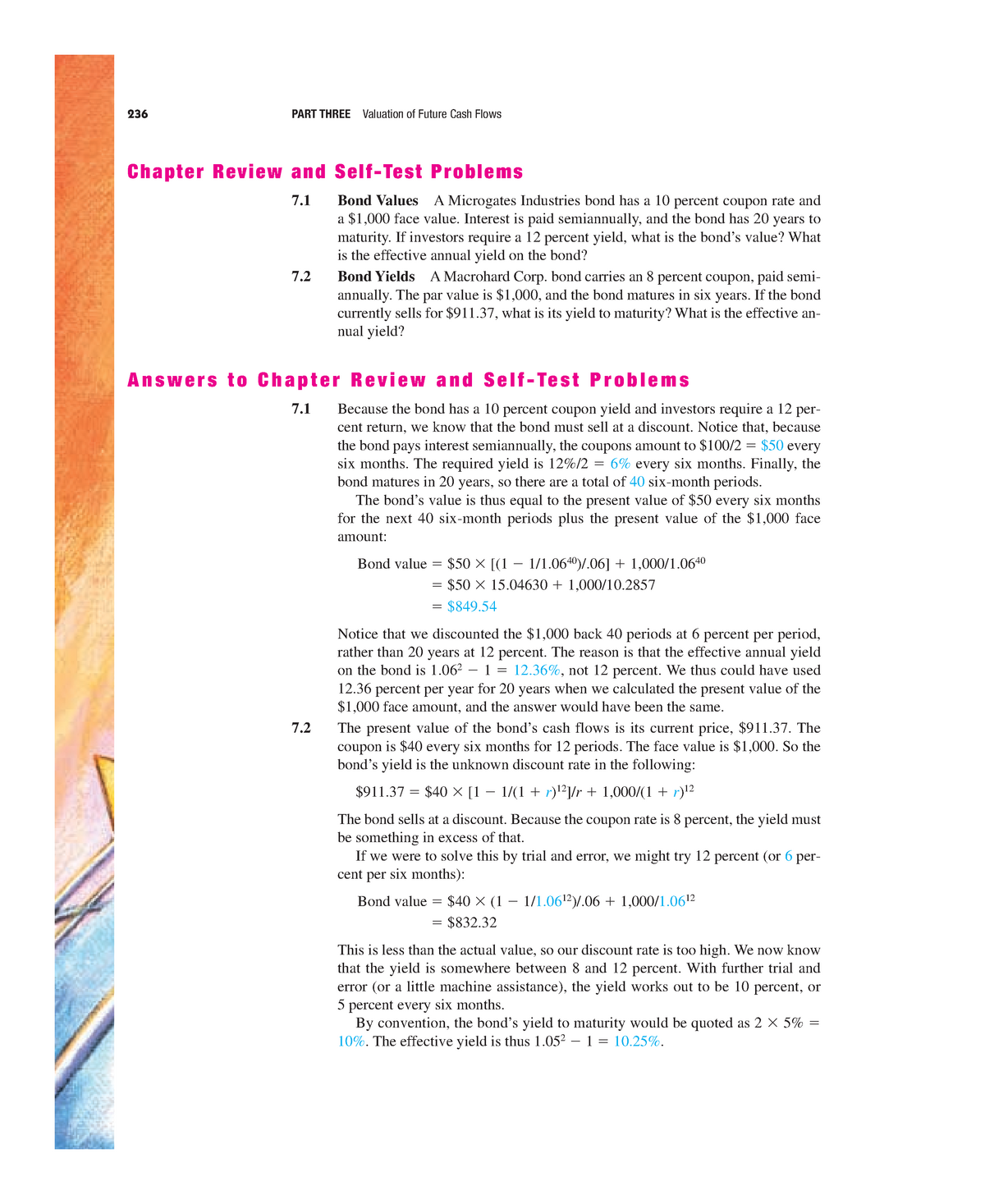

Solved Baxter Co. wants to issue new 16-year bonds for some - Chegg Expert Answer Transcribed image text: Baxter Co. wants to issue new 16-year bonds for some much-needed expansion projects. The company currently has 9 percent coupon bonds on the market that sell for $1,095, make semiannual payments, and mature in 16 years. Both bonds have a par value of $1,000. MSN MSN FIN Flashcards | Quizlet Study with Quizlet and memorize flashcards containing terms like West Corp. issued 18-year bonds 2 years ago at a coupon rate of 9.6 percent. The bonds make semiannual payments. If these bonds currently sell for 101 percent of par value, what is the YTM?, Yan Yan Corp. has a $2,000 par value bond outstanding with a coupon rate of 4.4 percent paid semiannually and 13 years to maturity. The ...

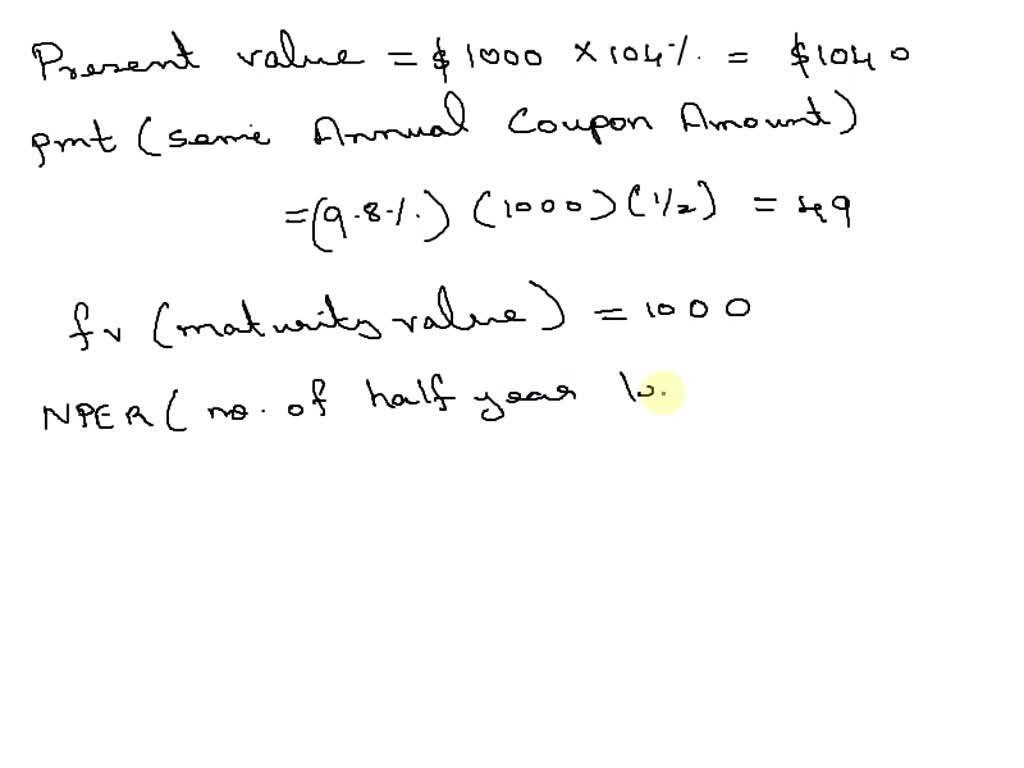

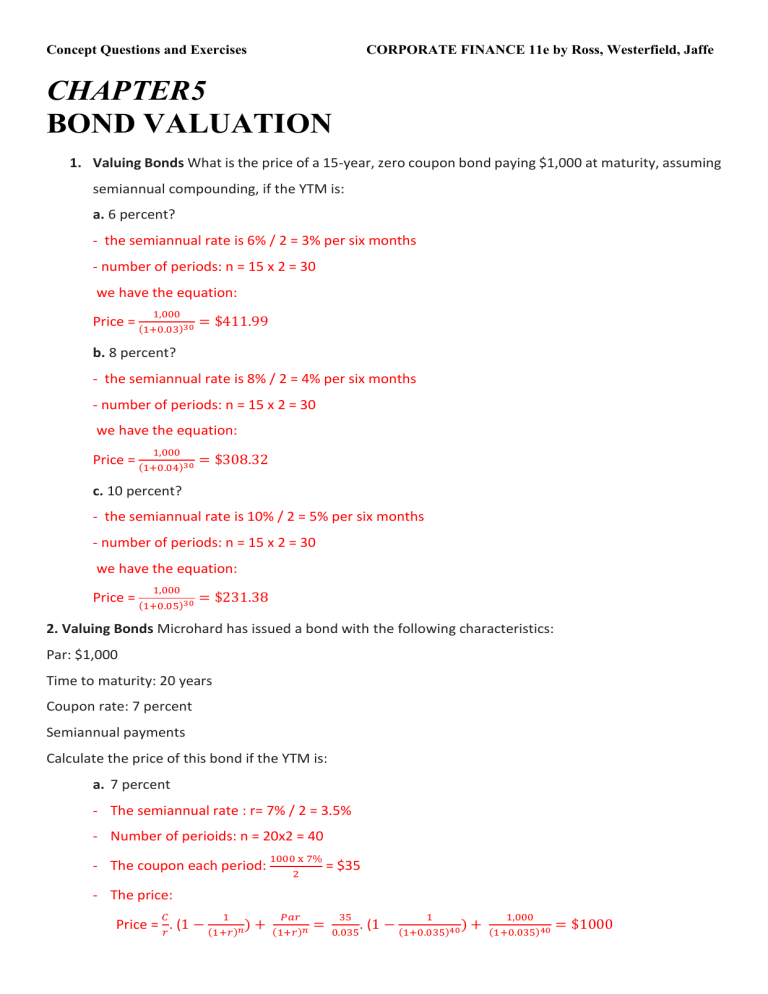

What coupon rate should the company set on its new bonds if it wants them to sell at par. (Solved) - What coupon rate should the company set on its new bonds if ... The company currently has 7.5% coupon bonds on the market that sell for $1062, make semi-annual payments and mature in twenty years. What coupon rate should the company set on its new bonds if it wants them to sell at par? The current bonds have a face value of $1000. What Coupon Rate Should The Company Set On Its New Bonds If It Wants ... A company currently has 10 percent coupon bonds on the market that sell for 1,063, make semiannual payments, and mature in 20 years. The bonds make semiannual payments and currently sell for 104 percent of par. Solved Uliana Company wants to issue new 15-year bonds for - Chegg The company currently has 9 percent coupon bonds on the market that sell for $1,070, make semiannual payments, and mature in 15 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Answer in Finance for rim #9185 - Assignment Expert What coupon rate should the company set on its new bonds if it wants them to sell at par? 6.25 percent 6.37 percent 6.50 percent 6.67 percent 6.75 percent Expert's answer Coupon rate is annual payout as a percentage of the bond's par value. Compounding = semi annually Par Value = 1000 Market Rate = 6.5 Market Price = 972.78 N = 40

Solved LKM, Inc. wants to issue new 20-year bonds for some - Chegg The same rates as the yield to maturity on the Question: LKM, Inc. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6.5 percent coupon bonds on the market that sell for $972.78, make semiannual payments, and mature in 20 years. 7.6-7.7 Bonds: Inflation, Interest Rates,and Determinants of ... - Quizlet the ease in which an asset can be converted to cash without significant loss of value RWB Inc., has 6% coupon bonds on the market that have 10 years left to maturity. The bonds make annual payments. If the YTM on these bonds is 11%, what is the current bond price? A. $705.54 B. $1,000.00 C. $1,061.61 D. $1,134.11 E. $1,368.00 A. $705.54 Home | NextAdvisor with TIME NextUp. The 25 Most Influential New Voices of Money. This is NextUp: your guide to the future of financial advice and connection. Explore the list and hear their stories. Callable (or Redeemable) Bond Types, Example, Pros & Cons - Investopedia Apr 02, 2022 · Callable Bond: A callable bond is a bond that can be redeemed by the issuer prior to its maturity. If interest rates have declined since the company first issued the bond, the company is likely to ...

Archives - Los Angeles Times Nov 23, 2020 · Any reader can search newspapers.com by registering. There is a fee for seeing pages and other features. Papers from more than 30 days ago are available, all the way back to 1881. Business Finance Ch6 Quiz - Connect Flashcards | Quizlet Study with Quizlet and memorize flashcards containing terms like Union Local School District has bonds outstanding with a coupon rate of 3.3 percent paid semiannually and 20 years to maturity. The yield to maturity on these bonds is 3.7 percent and the bonds have a par value of $10,000. What is the price of the bonds? (Do not round intermediate calculations and round your answer to 2 decimal ... Coupon Rate the Company Should Set on Its New Bonds - BrainMass 418233 Bond coupon rate and yield to maturity Not what you're looking for? Search our solutions OR ask your own Custom question. A company currently has 10 percent coupon bonds on the market that sell for 1,063, make semiannual payments, and mature in 20 years. All classifieds - Veux-Veux-Pas, free classified ads Website All classifieds - Veux-Veux-Pas, free classified ads Website. Come and visit our site, already thousands of classified ads await you ... What are you waiting for? It's easy to use, no lengthy sign-ups, and 100% free! If you have many products or ads, create your own online store (e-commerce shop) and conveniently group all your classified ads in your shop! Webmasters, …

What coupon rate should the company set on its new bonds if it wants ... What coupon rate should the company set on its new bonds if it wants them to from FINA 6320 at University of Texas, Permian Basin. Study Resources. Main Menu; by School; by Literature Title; ... What coupon rate should the company set on its new. School University of Texas, Permian Basin; Course Title FINA 6320;

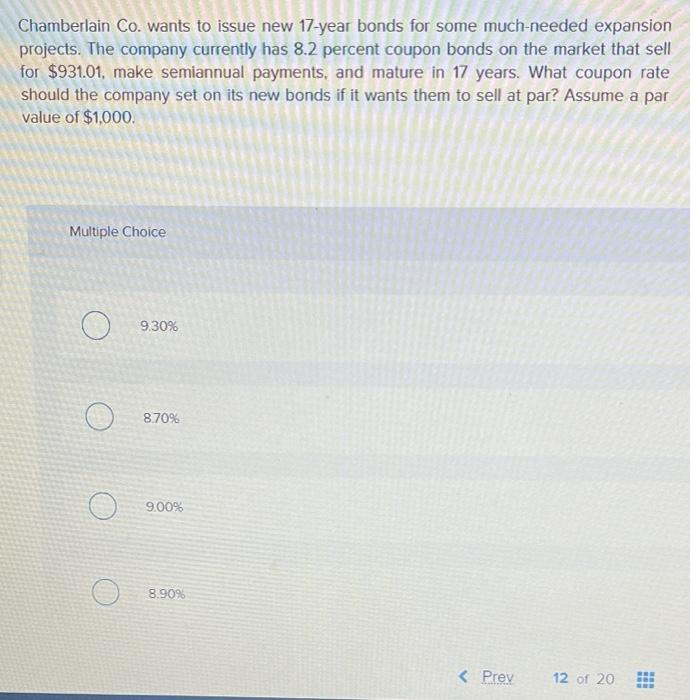

Chamberlain Co. wants to issue new 16-year bonds for some, much-needed expansion projects. The company currently has 12.0, percent coupon bonds on the market that sell for 1,403.43, make, semiannual ...

Bond Yields: Uliana Co. wants to issue new 20-year bonds for some much ... Rate = 3.15% Second step is to calculate the coupon rate Yield to Maturity = 3.15% x 2 Yield to Maturity = 6.3% Inconclusion the coupon rate that the company should set on its new bonds if it wants them to sell at par is 6.3%. Learn more here: brainly.com/question/2209742 Advertisement Advertisement

Entertainment & Arts - Los Angeles Times The first English-language feature from the Danish director Tobias Lindholm (‘A War,’ ‘A Hijacking’) tells the real-life story of a hospital worker’s horrific 1988-2003 killing spree.

Solved RAK Co. wants to issue new 20-year bonds for some - Chegg The company currently has 6 percent coupon bonds on the market that sell for $1,055, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

(a) What coupon rate should the company set on its new bonds if it ... Question (a) What coupon rate should the company set on its new bonds if it… Image transcription text(a) What coupon rate should the company set on its new bonds if it wants them to sell at par? (b) Thecompany's competitor has 6.2 percent coupon bond on the market with 9…

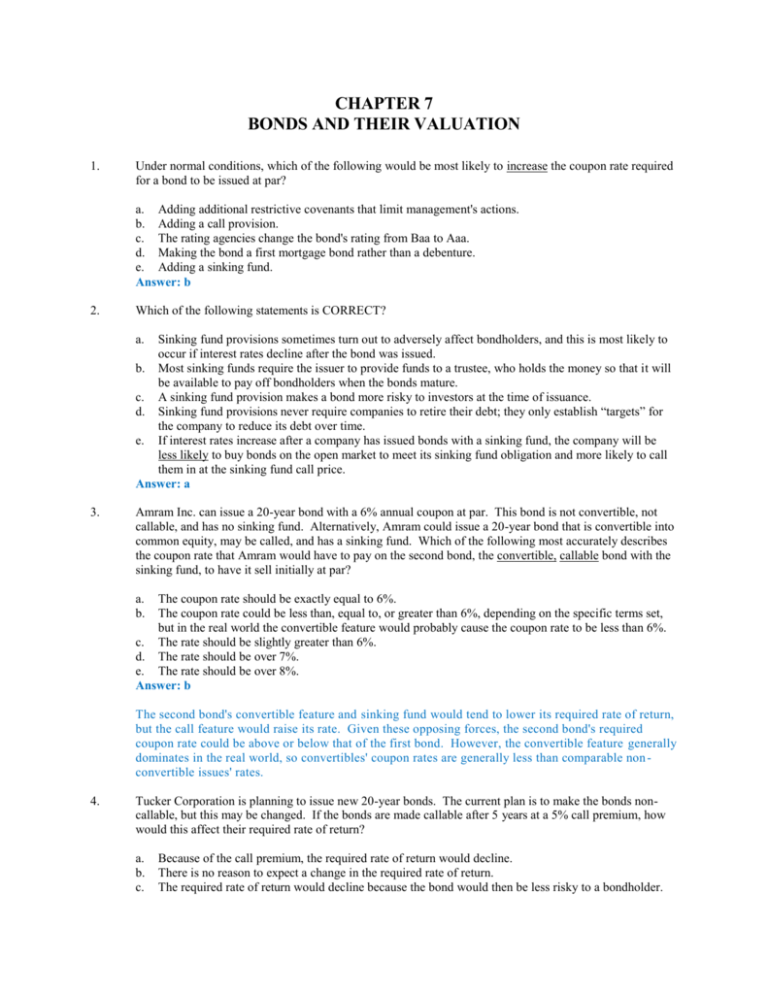

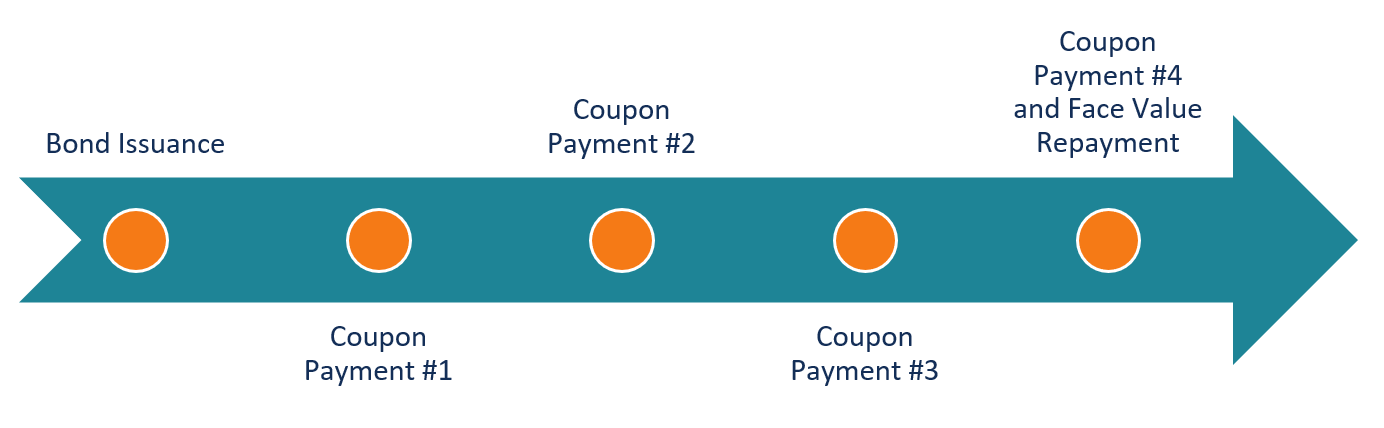

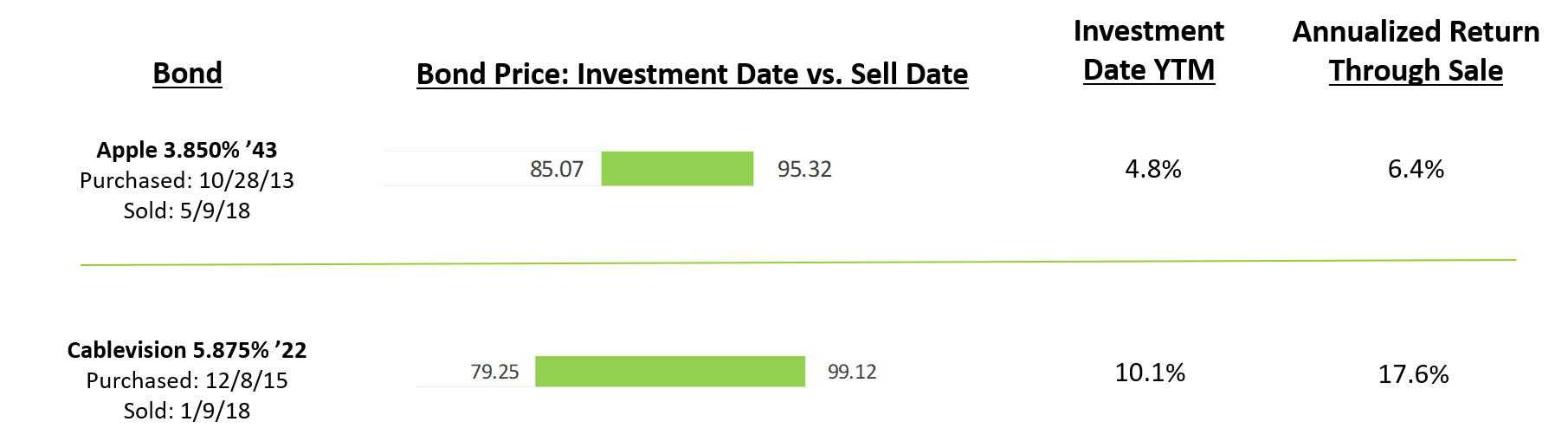

Relationship Between Interest Rates & Bond Prices - Investopedia May 16, 2022 · These examples also show how a bond's coupon rate and, consequently, its market price is directly affected by national interest rates. To have a shot at attracting investors, newly issued bonds ...

Solved Uliana Company wants to issue new 18-year bonds for - Chegg What coupon rate should the company set on its new bonds if it wants them to sell at par? Expert Answer 100% (4 ratings) Solution : Given, Maturity of the bond in years = 18 Coupon rate = 9% Current price of the bond, PV = $1,045 Par value of the bond, FV = $1,000 Semi-a … View the full answer Previous question Next question

Interest rate - Wikipedia A company borrows capital from a bank to buy assets for its business. In return, the bank charges the company interest. ... coupon rate is the ratio of the annual coupon amount (the coupon paid per year) per unit of par value, ... In July 2009, Sweden's central bank, the Riksbank, set its policy repo rate, the interest rate on its one-week ...

FIN Flashcards | Quizlet Study with Quizlet and memorize flashcards containing terms like West Corp. issued 18-year bonds 2 years ago at a coupon rate of 9.6 percent. The bonds make semiannual payments. If these bonds currently sell for 101 percent of par value, what is the YTM?, Yan Yan Corp. has a $2,000 par value bond outstanding with a coupon rate of 4.4 percent paid semiannually and 13 years to maturity. The ...

MSN MSN

Solved Baxter Co. wants to issue new 16-year bonds for some - Chegg Expert Answer Transcribed image text: Baxter Co. wants to issue new 16-year bonds for some much-needed expansion projects. The company currently has 9 percent coupon bonds on the market that sell for $1,095, make semiannual payments, and mature in 16 years. Both bonds have a par value of $1,000.

![Answered: 22. Bond Yields [LO2] Chamberlain Co.… | bartleby](https://content.bartleby.com/qna-images/question/008cf799-b2df-467b-ba48-3247e8c37d8e/f5990102-496c-4003-ab93-17975daef766/jlmvts6_processed.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

Post a Comment for "39 what coupon rate should the company set on its new bonds if it wants them to sell at par"