39 zero coupon bond yield calculation

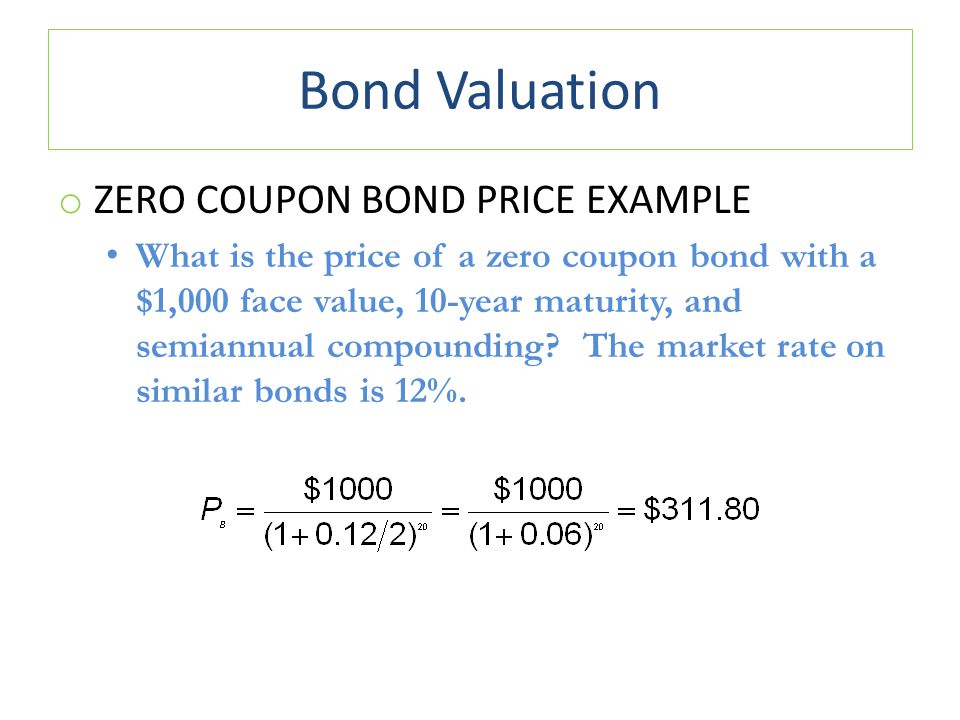

Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? How to Calculate the Yield of a Zero Coupon Bond? - Counting Accounting So for example let's say that you bought a bond for $95,238.The face value of the bond was $100,000. So because it's a zero-coupon bond that we're talking about there's not going to be any periodic interest payments or anything like that it's just a simple 1-year bond where you pay $95,238 in a year from now and get $100,000 returned to you.

Zero Coupon Bond Effective Yield Calculator | StableBread Bond Pricing Calculator: Clean/Flat Price, Dirty/Market Price, and Accrued Interest. Credit Spread Calculator. Current Yield Calculator. Tax-Equivalent Yield (TEY) Calculator. Yield to Call (YTC) Calculator. Yield to Maturity (YTM) Calculator. Zero Coupon Bond Effective Yield Calculator. Zero Coupon Bond Value Calculator.

Zero coupon bond yield calculation

Bond YTM Calculator | Calculate Bond Yield To Maturity online Bond yield calculator to calculate Yield To Maturity (YTM) of a coupon paying bond. This calculator also calculates accrued interest, dirty price, settlement amount and Bond Duration. Bond cash flows are also generated. To calculate YTM on zero coupon bond, use Zero Coupon Bond Yield Calculator. Bond Details: Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of ... Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero coupon bond yield calculation. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top Zero coupon bond price formula - KeaghanCaera Yield to maturity for zero-coupon bonds is calculated as. YTM sqrtn fracFacevalueCurrentprice - 1 Example of YTM of a zero-coupon bond calculation. Time the coupon value of the is is is zero zcbv a following the rate- t maturity- bond- r value of used the bond coupon the formula f 1 is bond is rt- value- fa. The present value PV the first step ... How to Calculate the Yield of a Zero Coupon Bond Using Forward Rates? Then now we just subtract 1 from each side so that's gonna give us 0.066 is equal to our yield to maturity on a five-year zero-coupon bond and another way of expressing that 0.066 is 6.6% that's the same thing it's just our way of expressing that decimal.

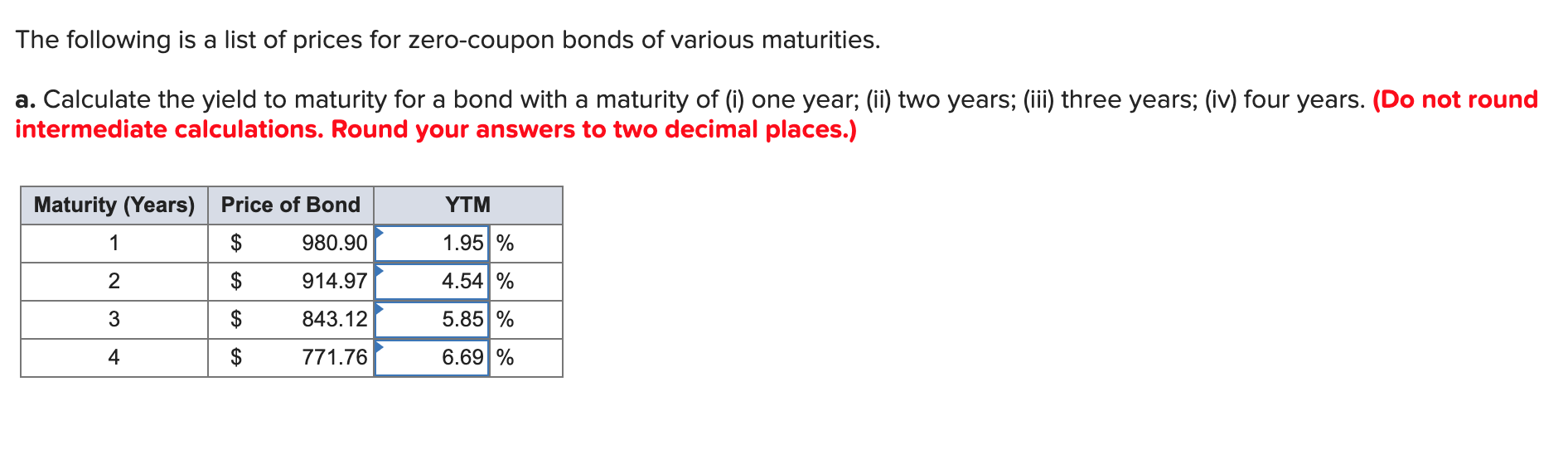

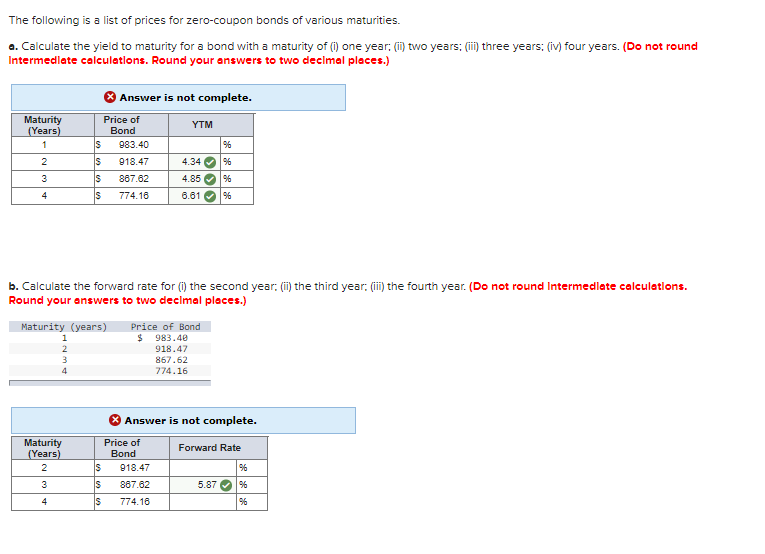

Zero Coupon Bond Calculator - Calculator Academy Zero Coupon Bond Formula The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t where ZCBV is the zero-coupon bond value F is the face value of the bond r is the yield/rate t is the time to maturity Zero Coupon Bond Definition How to Calculate Bond Price in Excel (4 Simple Ways) Method 1: Using Coupon Bond Price Formula to Calculate Bond Price. Users can calculate the bond price using the Present Value Method (PV). In the method, users find the present value of all the future probable cash flows. Present Value calculation includes Coupon Payments and face value amount at maturity. The typical Coupon Bond Price formula is The following is a list of prices for zero-coupon | Chegg.com Transcribed image text: The following is a list of prices for zero-coupon bonds of various maturities. a. Calculate the yield to maturity for a bond with a maturity of (i) one year; (ii) two years; (iii) three years; (iv) four years. Assume annual coupon payments. (Do not round intermediate calculations. Round your answers to 2 decimal places.) b. Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Step 2: Calculation of bond yield Bond Yield = Annual Coupon Payment/Bond Price =$78/$1600 Bond Yield will be - =0.04875 we have considered in percentages by multiplying with 100's =0.048*100 Bond Yield =4.875% Here we have to saw that increase in bond prices results in the decrease in bond yield. Example #2

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter Now the thing to understand is how this yield is calculated, so for that, and there is a particular formula in terms of economics that helps us to calculate that yield. The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods Zero Coupon Bond Yield Calculator - Find Formula, Example & more Zero Coupon Bond Effective Yield = ( (Face Value of Bond / Present Value of Bond) ^ (1 / Period)) - 1 The process of solution we need to use is: Zero Coupon Bond Effective Yield = ( (1000 / 700) ^ (1 / 5)) - 1 Here, the bond will provide the investor with a yield of 7.39% What is the use of Zero Coupon Bond Yield Calculator? How to Calculate the Price of a Zero Coupon Bond First, divide 6 percent by 100 to get 0.06. Second, add 1 to 0.06 to get 1.06. Third, raise 1.06 to the second power to get 1.1236. Lastly, divide the face value of $2,000 by 1.1236 to find that the price to pay for the zero-coupon bond is $1,880. 00:00 00:00. Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

Zero Coupon Bond Value Calculator - Find Formula, Example & more A zero coupon bond which has a face value of Rs.1000 is issued at the rate of 6%. So, now let us solve it. The formula is: Zero Coupon Bond Value = Face Value of Bond / (1 + Rate of Yield) ^ Time of Maturity. Following which the workout will be: Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5. When we solve the equation barely by hand or use the ...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay for this bond if the discount rate is 7%.

How do I Calculate Zero Coupon Bond Yield? - Smart Capital Mind The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check.

Zero Coupon Bond Effective Yield Calculator Zero Coupon Bond Effective Yield Solution STEP 0: Pre-Calculation Summary Formula Used Zero Coupon Bond Effective Yield = (Face Value/Present Value)^ (1/Number of Periods)-1 ZCB Yield = (F/PV)^ (1/n)-1 This formula uses 4 Variables Variables Used

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of ...

Bond YTM Calculator | Calculate Bond Yield To Maturity online Bond yield calculator to calculate Yield To Maturity (YTM) of a coupon paying bond. This calculator also calculates accrued interest, dirty price, settlement amount and Bond Duration. Bond cash flows are also generated. To calculate YTM on zero coupon bond, use Zero Coupon Bond Yield Calculator. Bond Details:

Post a Comment for "39 zero coupon bond yield calculation"